Compliance program

We find that the vast bulk of Territory tax and royalty payers meet their obligations on time and in full. Our aim is to encourage and assist clients to comply and to use our compliance powers sparingly. We will use the full force of the law for those who choose not to engage with us and refuse to comply with their taxation or royalty obligations.

Encourage and assist clients to comply

We have a range of information and tools available on our website to ensure clients understand their obligations and the benefits they are entitled to. These include:

- forms, factsheets and publications

- tax and duties calculators

- online services for easy lodgement and payment

- links to payroll tax seminars, videos and webinars.

We also provide telephone and email support to assist clients across all our tax, royalty and benefits schemes. Seminars are held in Darwin and regional centres as required to inform businesses, solicitors, accountants and professional advisors of changes and issues relating to the legislation we administer. If we think that you may not have complied with your obligations, we will generally inform you and seek your feedback before taking serious compliance action.

Detect and enforce compliance

Our compliance program focuses on areas identified as having a high risk of non-compliance, with audit and investigation projects focusing on:

- identifying and contacting individuals or businesses not currently registered within the tax system, but who are most likely to have a liability

- identifying clients who may have understated their tax and royalty liabilities through an audit program

- identifying clients who do not satisfy the eligibility requirements of the First Home Owner Grant

- prosecuting serious breaches of the legislation

- ensuring clients with an obligation to lodge returns do so in a timely manner.

Cases for audit and investigation are selected from a number of different sources. These include:

- voluntary and anonymous disclosures reported to the Territory Revenue Office

- validation and exception reporting to identify anomalies with information presented by clients

- referrals from other agencies

- verifying our records against third party information to identify potential cases of non-compliance.

For more information on the investigation process, read the Investigation process section.

Information exchange with the Australian Taxation Office and revenue offices

We regularly exchange information with the Australian Taxation Office (ATO) and other revenue offices in accordance with the Memorandum of Understanding signed by the ATO and all State and Territory revenue offices. We use shared information and data including:

- BAS and Income Tax return data to identify those businesses that should be registered for payroll tax

- matching business wages and salaries data from the ATO to identify variances for payroll tax

- matching fringe benefits tax data to identify variances for payroll tax

- using Income Tax data to identify when properties have been rented out by recipients of the First Home Owner Grant

- comparing levels of wages declared by employers to different States and Territories

- to identify discrepancies in property related sales for duties purposes.

The ATO uses our information to:

- identify businesses who should be registered for pay as you go withholding tax

- identify discrepancies in property related sales to income tax, goods and services tax, fringe benefits tax and capital gains tax.

If you have state and territory tax liabilities, you may also have federal tax and superannuation liabilities. For example, if you need to lodge a payroll tax return you will also need to withhold tax from payments to employees and provide superannuation. You should check your federal tax and superannuation obligations by visiting the ATO website.

Prosecuting evasions and fraud

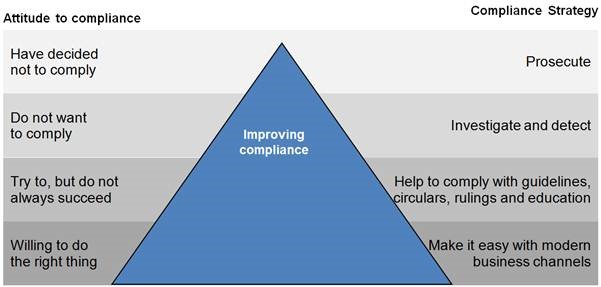

As the administrator of tax, mineral royalty and benefits schemes, we protect honest taxpayers, royalty payers and benefit scheme recipients from those seeking to abuse the system (by failing to pay mandated taxes or royalties, or claiming benefits to which they are not otherwise entitled, thus shifting heavier burdens to honest taxpayers and royalty payers). In appropriate cases where taxpayers, royalty payers or benefit scheme recipients have contravened a provision of a statute, we may institute prosecutions. We will use the least interventionist form of regulation that will deliver and improve compliance.

Prosecutions are part of that overall strategy, as demonstrated by the diagram below:

Concept adapted from I Ayres and J Braithwaite, Responsive Regulation: Transcending the Deregulation Debate (Oxford University Press, 1992)

In choosing to commence a prosecution action, we will act in an independent, professional and effective manner which:

- maintains and promotes community confidence in the integrity, neutrality and effectiveness of the revenue and home owner assistance schemes

- promotes our overall objective of improving compliance with revenue and benefits schemes

- improves the transparency of the decision making process

- ensures consistency of treatment of alleged offenders

- is fair and just to both the alleged offender and the community

- is sensitive to the needs of witnesses and to the interests of the community on whose behalf we act.

We are prepared to prosecute all types of offences (whether serious or less serious offences).

Voluntary and anonymous disclosures

If you have understated your liability, you need to submit a voluntary disclosure to the Territory Revenue Office. When a voluntary disclosure is made, a reduced level of penalties are imposed compared to those cases where the understatement is identified by our office. For payroll tax voluntary disclosures, employers can make a submission by email to ntrevenue@nt.gov.au. For more details on how we apply interest and penalties, refer to Commissioner’s Guideline CG-GEN-002: Interest and penalty tax. We also investigate anonymous disclosures from members of the public. Confidentiality is assured and we welcome any information about non-compliance relating to the tax, royalty or home incentive schemes we administer. Anonymous disclosures can be reported to us over the phone on 1300 305 353 or by email to nrevenue@nt.gov.au.

Give feedback about this page.

Share this page:

URL copied!