Compliance

We find that the vast bulk of Territory tax and royalty payers meet their obligations on time and in full. Our aim is to encourage and assist clients to comply and to use our compliance powers sparingly. We will use the full force of the law for those who choose not to engage with us and refuse to comply with their taxation or royalty obligations.

Encourage and assist clients to comply

We have a range of information and tools available on our website to ensure clients understand their obligations and the benefits they are entitled to. These include:

- forms, factsheets and publications

- tax and duties calculators

- online services for easy lodgement and payment

- links to payroll tax seminars, videos and webinars.

We also provide telephone and email support to assist clients across all our tax, royalty and benefits schemes. Seminars are held in Darwin and regional centres as required to inform businesses, solicitors, accountants and professional advisors of changes and issues relating to the legislation we administer. If we think that you may not have complied with your obligations, we will generally inform you and seek your feedback before taking serious compliance action.

Detect and enforce compliance

Our compliance program focuses on areas identified as having a high risk of non-compliance, with audit and investigation projects focusing on:

- identifying and contacting individuals or businesses not currently registered within the tax system, but who are most likely to have a liability

- identifying clients who may have understated their tax and royalty liabilities through an audit program

- identifying clients who do not satisfy the eligibility requirements of the First Home Owner Grant

- prosecuting serious breaches of the legislation

- ensuring clients with an obligation to lodge returns do so in a timely manner.

Cases for audit and investigation are selected from a number of different sources. These include:

- voluntary and anonymous disclosures reported to the Territory Revenue Office

- validation and exception reporting to identify anomalies with information presented by clients

- referrals from other agencies

- verifying our records against third party information to identify potential cases of non-compliance.

For more information on the investigation process, read the Investigation process section.

Information exchange with the Australian Taxation Office and revenue offices

We regularly exchange information with the Australian Taxation Office (ATO) and other revenue offices in accordance with the Memorandum of Understanding signed by the ATO and all State and Territory revenue offices. We use shared information and data including:

- BAS and Income Tax return data to identify those businesses that should be registered for payroll tax

- matching business wages and salaries data from the ATO to identify variances for payroll tax

- matching fringe benefits tax data to identify variances for payroll tax

- using Income Tax data to identify when properties have been rented out by recipients of the First Home Owner Grant

- comparing levels of wages declared by employers to different States and Territories

- to identify discrepancies in property related sales for duties purposes.

The ATO uses our information to:

- identify businesses who should be registered for pay as you go withholding tax

- identify discrepancies in property related sales to income tax, goods and services tax, fringe benefits tax and capital gains tax.

If you have state and territory tax liabilities, you may also have federal tax and superannuation liabilities. For example, if you need to lodge a payroll tax return you will also need to withhold tax from payments to employees and provide superannuation. You should check your federal tax and superannuation obligations by visiting the ATO website.

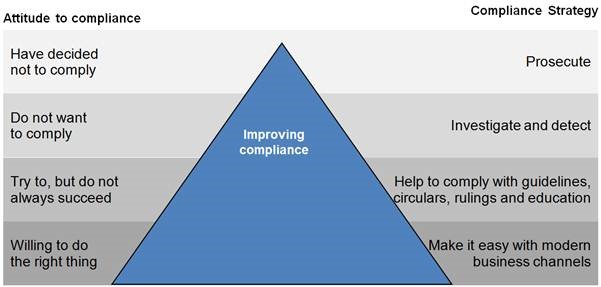

Prosecuting evasions and fraud

As the administrator of tax, mineral royalty and benefits schemes, we protect honest taxpayers, royalty payers and benefit scheme recipients from those seeking to abuse the system (by failing to pay mandated taxes or royalties, or claiming benefits to which they are not otherwise entitled, thus shifting heavier burdens to honest taxpayers and royalty payers). In appropriate cases where taxpayers, royalty payers or benefit scheme recipients have contravened a provision of a statute, we may institute prosecutions. We will use the least interventionist form of regulation that will deliver and improve compliance.

Prosecutions are part of that overall strategy, as demonstrated by the diagram below:

Concept adapted from I Ayres and J Braithwaite, Responsive Regulation: Transcending the Deregulation Debate (Oxford University Press, 1992)

In choosing to commence a prosecution action, we will act in an independent, professional and effective manner which:

- maintains and promotes community confidence in the integrity, neutrality and effectiveness of the revenue and home owner assistance schemes

- promotes our overall objective of improving compliance with revenue and benefits schemes

- improves the transparency of the decision making process

- ensures consistency of treatment of alleged offenders

- is fair and just to both the alleged offender and the community

- is sensitive to the needs of witnesses and to the interests of the community on whose behalf we act.

We are prepared to prosecute all types of offences (whether serious or less serious offences).

Voluntary and anonymous disclosures

If you have understated your liability, you need to submit a voluntary disclosure to the Territory Revenue Office. When a voluntary disclosure is made, a reduced level of penalties are imposed compared to those cases where the understatement is identified by our office. For payroll tax voluntary disclosures, employers can make a submission by email to ntrevenue@nt.gov.au. For more details on how we apply interest and penalties, refer to Commissioner’s Guideline CG-GEN-002: Interest and penalty tax. We also investigate anonymous disclosures from members of the public. Confidentiality is assured and we welcome any information about non-compliance relating to the tax, royalty or home incentive schemes we administer. Anonymous disclosures can be reported to us over the phone on 1300 305 353 or by email to nrevenue@nt.gov.au.

We use a number of compliance strategies within each of the tax, royalty and benefit schemes we administer. We aim to complete our audits and investigations with the highest possible standards of integrity and least inconvenience to our clients. Our Investigation process section provides clients with information about the audit and investigation process, their rights and obligations and avenues of appeal if they are dissatisfied with an assessment of liability.

Duties

Our duties compliance program focuses on individual transactions and Conveyance By Return (CBR) clients who stamp documents. Initiatives to ensure duties compliance may include:

- identifying transactions liable for landholder duty

- auditing CBR clients to ensure the accuracy of stamping and that their systems and procedures adhere to our directions

- identifying transactions where duty has not been paid or underpaid

- reviewing high value property transfers

- identifying and investigating transactions where the correct value has not been used to calculate duty payable

- reviewing and investigating sale of business transactions where third party information indicates that the correct duty has not been paid

- reviewing entitlement to exemptions and concessions, including corporate reconstructions.

Payroll tax

Payroll tax compliance activities focus on identifying and contacting liable employers who have failed to register for payroll tax in the Territory and auditing registered clients who appear to have understated their wages. Initiatives to ensure payroll tax compliance may include:

- contacting unregistered employers where information available to us suggests they are liable for payroll tax

- investigating businesses where information available to us indicates taxable wages have been understated

- identifying and contacting employer groups that are claiming the benefit of multiple thresholds by failing to declare they belong to a group for payroll tax purposes

- reviewing high value refund requests

- contacting and reviewing employers who fail to declare payments to contractors that are liable for payroll tax

- following up employers who fail to lodge their monthly and/or annual returns on time.

Common errors for payroll tax include:

- failing to register when total liable wages exceed the Northern Territory threshold

- failing to include all liable wages in the total wages calculation, including superannuation and taxable fringe benefits

- incorrectly classifying employees as independent contractors - in certain cases 'contractors' may be considered to be 'employees' under the Act

- incorrectly listing group status, including failing to register a related entity such as:

- holding subsidiary relationships (mandatory grouping)

- common control relationships (common shareholders/directors/beneficiaries or any combination of these)

- common use of employees

- failing to declare interstate wages

- incorrectly claiming an exemption for certain wages.

First Home Owner Grant

Compliance activities ensure first home buyers benefiting from the First Home Owner Grant (FHOG) scheme satisfy the eligibility criteria. All first home buyers who receive the FHOG are matched against information held by third parties and may be requested to verify that they have met the eligibility criteria, including the residence requirement. Applicants who are not eligible for the FHOG are required to repay the grant back to us, which may include penalty and/or interest. FHOG applicants who provide false or misleading statements may be prosecuted.

Initiatives to ensure first home benefits compliance may include:

- identifying and investigating applicants who fail to meet the residence requirements

- verifying information provided by clients against third party data to identify undeclared spouses, prior ownership, understated duty amounts and inconsistencies between property transfers and FHOG applications

- investigating anonymous disclosures reported to the Territory Revenue Office.

Common errors for the FHOG include:

- applying for FHOG when purchasing an investment property that is to be leased

- failing to advise us when circumstances change and the applicant cannot meet the residence requirement timeframes

- incorrectly applying the residency requirements, for example:

- leaving the FHOG property vacant (not leased) for 6 months

- renovating the FHOG property while using another residence to cook, shower, sleep etc

- living in the FHOG property for a period of less than 6 months

- failing to disclose a de facto partner/spouse

- failing to disclose that the applicant, or their de facto partner/spouse has received a prior grant or had a prior relevant interest in residential property

- failing to disclose previous names, including previous married name(s)

- purchasing the FHOG property in a child’s name, with the consideration for the property paid by parents.

Mineral and petroleum royalties

The Northern Territory’s mineral and petroleum royalty regimes operate on the principle of voluntary compliance. Each royalty payer is responsible for paying the correct amount of royalties (including provisional royalties) imposed by the statutory or regulatory framework that governs the royalty regimes. We are responsible for administering and enforcing those regimes.

Audits help:

- ensure that all royalty payers pay the correct amount of royalties

- promote a level playing field for all Northern Territory mining, petroleum and other businesses or projects

- royalty payers to understand how royalties apply to their mining or petroleum business or project.

Any royalty payer – including major, national or junior companies and individual or small scale miners – could be audited. Royalty payers may be chosen for an audit based on a special audit project, legislated program, risk-based selection or referral from another tax or royalty audit. Royalty payers based outside the Northern Territory that conduct mining or petroleum production in the Northern Territory could also be audited. The Mineral Royalty Act 1982 – Mineral royalty overview PDF (237.2 KB), Mineral Royalties Act 2024 – Mineral royalty overview DOCX (749.8 KB) and NT Petroleum Royalty Overview DOCX (224.6 KB) specify the obligations of royalty payers and cover administrative details such as the reporting of royalty obligations and the conduct of audits.

The Territory Revenue Office (TRO) aims to administer Northern Territory revenue laws in a fair and equitable manner. Our tax systems rely on the honesty of taxpayers to voluntarily comply with their obligations.

Why investigate?

Investigations are conducted to ensure taxpayers pay the correct amount of tax or duty. As a part of the investigation process we assist taxpayers to update their tax affairs, and raise the businesses’ awareness of their current and future tax obligations. This protects the integrity of our tax system and ensures equity for all taxpayers.

The investigation process also helps identify the education needs of taxpayers, as well as issues that may require changes to policy and legislation.

How are cases selected?

A number of methods are used to select cases for investigation. Most often, investigations are conducted as a result of our research and data matching projects.

What if you are selected?

An investigator will:

- contact you advising that an investigation will be conducted

- explain the process and scope of the investigation

- specify what records are required to be produced

- allow reasonable time for you to produce records.

If the investigator is visiting your office they will:

- make an appointment with yourself, or your representative

- confirm all arrangements.

During the process the investigator may ascertain your compliance with the legislation by a combination of:

- examining your financial and business records

- requesting further records or clarification

- interviewing you (or your representative)

- making other inquiries.

Prior to and during the investigation, you have the opportunity to disclose your liability.

At the conclusion of the investigation you will receive written advice on the outcome and notice of any proposed action. You will generally be given the opportunity to respond to our preliminary findings before the investigation is finalised.

All TRO staff are bound by confidentiality provisions. Information gathered during an investigation is treated with strictest confidence and is not used or divulged except for the purposes required by law.

What powers does an investigator have?

Under NT tax laws an investigator is permitted to:

- gain access to buildings and property

- inspect, examine, copy and seize books, documents or records

- require a person to produce records

- require a person to answer questions and provide information

- require a person to give reasonable assistance and facilities.

Penalties can be imposed under the relevant legislation if you fail to comply with an investigator’s lawful requests.

How do you prepare?

- Ensure all information and records requested by the investigator are ready for examination when needed.

- Provide accurate and complete information promptly to help reduce the length of the investigation process.

- Inform the investigator of any discrepancies or undeclared tax liabilities you may have found.

Note: Penalty tax can be reduced by cooperating fully with an investigation and by making a full and immediate disclosure of any tax liability.

- Seek advice from your legal or financial representative if the matters under investigation are complex.

- Direct any questions you have regarding the investigation process to the investigator.

Before an investigation, you have the right to:

- request reasonable time to produce records

- negotiate with the investigator a time and place for any interview

- receive written confirmation of the agreed arrangements.

During an investigation, you have the right to:

- be treated in a professional and courteous manner by the investigator

- view the investigator’s identification authority

- involve your financial or legal representatives

- ask how long the investigation will take

- expect your affairs to be treated with strict confidentiality

- obtain a receipt for original records or other material the investigator removes from your office

- be given the opportunity to explain the reasons for any irregularities and discrepancies.

After an investigation, you have the right to:

- receive an explanation of the results or findings

- ask the investigator how penalty tax and interest provisions are to be applied

- ask for an explanation of the objection and appeal process

- discuss any aspect of the case with the investigator or their manager.

Your obligations:

- provide reasonable assistance and facilities to the investigator

- provide complete and honest answers and explanations to questions

- provide prompt, full and free access to all relevant records required, including documents, data and systems

- maintain proper books and accounts in the English language and preserve these records for a period of not less than 5 years.

Interest and penalty tax

The Taxation Administration Act 2007 imposes interest and penalty tax on a tax default. A tax default is a failure by a taxpayer to pay the whole or part of the tax that they are liable to pay under a taxation law. This includes not paying tax on time.

Interest and penalty tax are designed to deter non-compliance by making it unprofitable.

Interest is comprised of two rates being a premium rate (8%) and a market rate, which is reviewed annually. Current and historical rates are published on the TRO website.

The amount of penalty tax is set at a default rate of 25% of the amount of tax unpaid. This rate will be reduced or increased depending on the circumstances in each case.

Penalty tax will be substantially reduced if the Commissioner is satisfied that the taxpayer took reasonable care to comply and cooperated fully with the investigation. Conversely, it may be increased to 75% of the unpaid tax if the Commissioner is satisfied that the tax default arose wholly or partly from the intentional disregard of a taxation law.

For more detailed information, refer to Commissioner’s Guideline CG-GEN-002: Interest and penalty tax DOCX (740.4 KB).

Payment

An assessment will be issued to you if an underpayment of duty or tax is detected. The assessment must be paid in full by the date specified in the assessment notice.

If you are unable to make the payment by its due date, you may forward a written application, proposing alternative payment arrangements for consideration. For more information on instalment arrangements, refer to Commissioner’s Guideline CG-GEN-004: Instalment Arrangements DOCX (728.6 KB).

Note: interest is generally charged on amounts payable between the time when the debt becomes due and when it is paid in full.

Objections and appeals

A person who is dissatisfied with a decision, determination or assessment made by the Commissioner affecting their tax liability may, within a period of 60 days after the issue of notice of the decision, determination or assessment, lodge an objection in writing with the Commissioner.

The statement must be explicit, stating the full grounds of the objection and be accompanied by relevant supporting evidence.

The 60 day period may be extended if the Commissioner is satisfied that the taxpayer has a reasonable excuse for not lodging the objection within the 60 day period.

A person who is dissatisfied with a decision on an objection may, within 60 days after the date of issue of the notice of decision, appeal to the Taxation and Royalty Appeals Tribunal or Supreme Court against that decision. Decisions of the Tribunal may be appealed to the Supreme Court.

Lodgement of an objection or appeal does not affect the liability to pay any tax.

More information

If you need more details or clarification of any aspect of an investigation, you should ask the investigator assigned to your case or contact the Territory Revenue Office.

Give feedback about this page.

Share this page:

URL copied!