Mineral Royalty

This page provides a high level overview of mineral royalties in the Northern Territory.

On 1 July 2024, the Mineral Royalties Act 2024 imposed an ad valorem royalty scheme in the Territory. Mines in production during 2023 will remain under the profit-based royalty scheme of the Mineral Royalty Act 1982.

The Mineral Royalties Act 2024 – Mineral royalty overview DOCX (749.8 KB) and Mineral Royalties Act 1982 – Mineral royalty overview outline the administrative arrangements relating to the establishment, calculation and collection of mining royalties under the Mineral Royalties Act 2024 and Mineral Royalty Act 1982.

Still looking for answers? Take a look at our frequently asked questions.

Who owns minerals in the Northern Territory?

Minerals in the Northern Territory are owned by the people of the Territory. Once a mineral is removed from the ground it cannot be replaced.

What are mineral royalties and what are they used for?

Companies mining minerals pay to remove non‑renewable resources. This payment is known as a royalty.

Mining royalties contributed more than 41% to the Territory’s total own‑source revenue in 2019‑20 and are the single largest own‑source revenue. Royalties are used to fund important public services such as schools, hospitals and community safety.

How are mineral royalties calculated under the Mineral Royalty Act 1982?

Under the Mineral Royalty Act 1982, royalty is liable at the greater of 20% of net value (profit) minus $10,000 or a minimum royalty which is 1%, 2% or 2.5% of the gross production revenue (sales value of minerals).

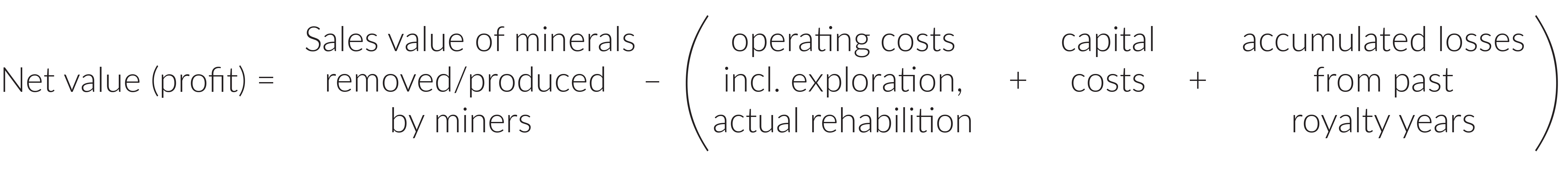

The formula to determine the net value is:

The net value can be either negative (if a mine makes a loss) or positive (when a mine is returning a profit). Where the net value is negative, it can be offset against profits in future years.

The minimum royalty for a mine is 1% in its first year of operation since 1 July 2019, 2% in its second year of operation and 2.5% for every subsequent year.

Here is an example of the calculation of royalty for the 2023‑24 financial year:

| Mine A (started 1 July 2015) | Mine B (started 1 July 2022) | |

| Sales value of minerals ($) | 100 000 000 | 100 000 000 |

| Operating costs ($) | (50 000 000) | (70 000 000) |

| Capital costs ($) | (20 000 000) | (40 000 000) |

| Accumulated losses ($) | (10 000 000) | (10 000 000) |

| Net value ($) | 20 000 000 | (20 000 000) |

| Net value royalty ($) | 3 990 000 | 0 |

| Minimum royalty (%) | 2.5 | 2.0 |

| Minimum royalty ($) | 2 500 000 | 2 000 000 |

| Royalty ($) | 3 990 000 | 2 000 000 |

Typically, only mature and more profitable mines will eventually transition to the 20% net value royalty while the less mature, unprofitable or marginal mining ventures will only have to pay the minimum royalty.

How are mineral royalties calculated under the Mineral Royalties Act 2024?

The Territory now uses an ad valorem scheme with multiple rates to calculate mineral royalties. Royalties for minerals are calculated based on the value of a mineral and by applying a royalty rate based on the level of processing performed on the mineral. A deduction is allowed from the value of the mineral for shipping costs incurred in the Territory.

Royalty = RR*(V – SC)

Where:

- RR is the royalty rate of a mineral

- V is the value of the mineral extracted from a mining operation

- SC is the amount allowed to be deducted for shipping costs within the Territory.

The ad valorem-base mineral royalty scheme focuses on the value of the minerals which considers changes in the market value of minerals and downstream value-adding. Moreover, its calculation system is relatively straightforward by mining companies, which is simple, competitive and incorporates modern.

Schedule 1 in the Mineral Royalties Act 2024 outlines the royalty rate that applies to a mineral. Where a mineral is not included in the schedule there are 4 categories for determining the appropriate rate of royalty. Each category represents a higher level of treatment or refinement of the mineral.

Give feedback about this page.

Share this page:

URL copied!