Borrowing and financing strategies

Financial markets

Borrowings

NTTC manages the Territory Government's exposure to funding risk by ensuring it is not subject to a significant refinancing risk in any financial year.

NTTC's approach to minimising funding risk involves the diversification of borrowing and investment activities across the maturity spectrum and utilising a variety of funding sources to meet its requirements.

Wholesale public issues

The primary source of funding for NTTC is Australian dollar denominated bonds issued in the wholesale market via syndication. In executing its borrowing program, NTTC’s strategy is to issue larger benchmark bond lines with a minimum balance of $500 million to meet investor demand for greater liquidity and to promote market awareness.

In 2023-24, NTTC issued three new benchmark-sized bond series to institutional investors in the Australian financial markets. In the period ahead, NTTC will continue to consider increases to the outstanding bond series to achieve benchmark bond status ensuring the level of maturing debt for each line is within the target band.

NTTC currently has 16 institutional bond issues:

| Maturity date | Coupon | Amount on issue |

|---|---|---|

| 15 March 2026 | 6.00% | A$650 million |

| 21 April 2027 | 2.75% | A$750 million |

| 21 April 2028 | 3.50% | A$750 million |

| 21 May 2029 | 2.00% | A$750 million |

| 21 May 2030 | 3.50% | A$850 million |

| 21 April 2031 | 2.00% | A$850 million |

| 21 May 2032 | 2.50% | A$850 million |

| 21 April 2033 | 3.75% | A$900 million |

| 21 March 2034 | 5.25% | A$850 million |

| 21 March 2035 | 4.50% | A$900 million |

| 21 March 2036 | 5.50% | A$850 million |

| 21 April 2037 | 5.75% | A$750 million |

| 21 May 2038 | 5.25% | A$600 million |

| 21 March 2041 | 2.75% | A$200 million |

| 21 November 2042 | 4.10% | A$850 million |

| 21 March 2051 | 3.00% | A$250 million |

Private placements

In addition to issuing benchmark bonds, private placements are used by NTTC to satisfy specific funding needs. Private placements are attractive because of the ease of issuance, which makes them suitable for small parcels of debt and their flexibility for tailoring to domestic market movements and investor demand.

Promissory notes

NTTC's short-term funding requirements are met through its promissory note facility. The notes are generally issued by way of tender to key institutional counterparties, using ASX (Austraclear Services Limited) as the issuing, lodging, recording and paying agent.

While NTTC had no promissory notes on issue as at 30 June 2024, the promissory note facility remains available to use during the year to meet short-term funding requirements.

Territory Bonds

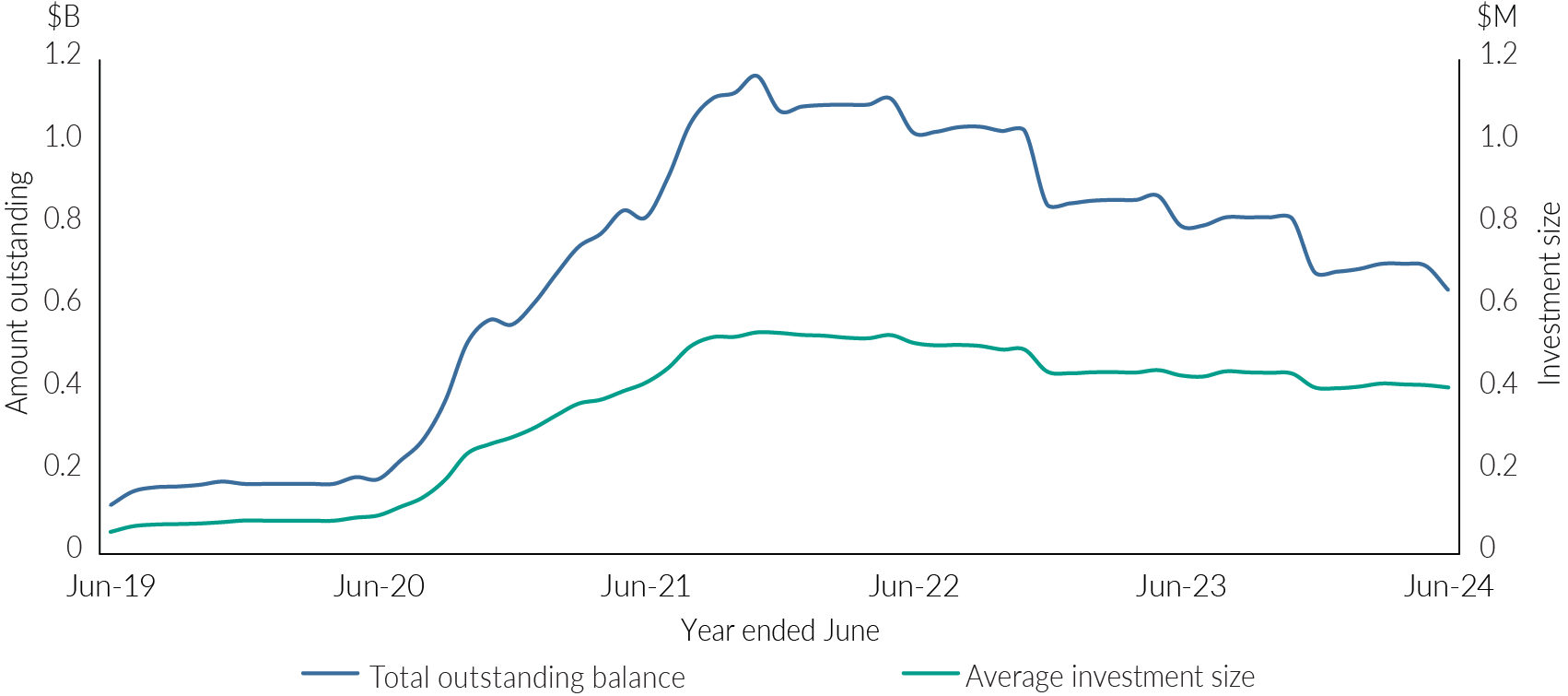

Territory Bonds is NTTC's retail fixed interest borrowing product and is used to attract funds from the general public. Territory Bonds have been issued since 1979 and are offered to investors seeking a safe, secure, government-guaranteed investment.

As at 30 June 2024, the total outstanding balance in Territory Bonds was about $641 million, with the number of registered investors decreasing to 1,585 compared with 1,839 recorded in June 2023.

Debt profile

NTTC borrows funds from the domestic and international financial markets by offering a range of financial products. The funds raised by NTTC assist to finance the Territory’s infrastructure requirements such as housing, transport, health and education services.

As at 30 June 2024, NTTC’s total outstanding domestic debt was about A$11 billion. Total borrowings in 2023-24 was about A$2.5 billion, which included $334 million of prefunding for 2024-25.

Credit rating

NTTC is rated Aa3 by Moody’s Investors Service with a stable outlook.

Government guarantee

All obligations incurred or assumed by NTTC are guaranteed by the Treasurer on behalf of the Territory under section 20 of the Northern Territory Treasury Corporation Act 1994.

Interest withholding tax on NTTC domestic bonds

On 9 December 2008, amendments to s.128F of the Income Tax Assessment Act 1936 came into effect to allow bonds issued in Australia by state and territory central borrowing authorities to be eligible for exemption from interest withholding tax (IWT).

The amendments apply to interest/coupon payments made on or after 9 December 2008, which means all domestic bonds, whether issued before or after that date, are eligible. The amendments do not necessarily exempt all bonds currently on issue, rather only those securities that otherwise meet the requirements of s.128F, specifically the public offer test.

In order to assist Australian custodians and paying agents holding bonds on behalf of offshore counterparties, NTTC wishes to make the following clarifications.

NTTC domestic bonds that qualify under s.128F

NTTC considers the following select lines of stock satisfy the relevant requirements of s.128F and are therefore exempt from IWT:

| Maturity date | Coupon | Coupon dates | Austraclear series ID | ISIN number |

|---|---|---|---|---|

| 15 March 2026 | 6.00% | 15 September and 15 March | NT2741 | AU000NT27410 |

| 21 April 2027 | 2.75% | 21 October and 21 April | NT2776 | AU3SG0001886 |

| 21 April 2028 | 3.50% | 21 October and 21 April | NT2772 | AU3SG0001738 |

| 21 May 2029 | 2.00% | 21 November and 21 May | NT2777 | AU3SG0001951 |

| 21 May 2030 | 3.50% | 21 November and 21 May | NT2775 | AU3SG0001845 |

| 21 April 2031 | 2.00% | 21 April and 21 October | NT2778 | AU3SG0002074 |

| 21 May 2032 | 2.50% | 21 May and 21 November | NT2779 | AU3SG0002470 |

| 21 April 2033 | 3.75% | 21 October and 21 April | NT2774 | AU3SG0001795 |

| 21 March 2034 | 5.25% | 21 September and 21 March | NTTC02 | AU3SG0003049 |

| 21 March 2035 | 4.50% | 21 September and 21 March | NTTC01 | AU35G0002785 |

| 21 March 2036 | 5.50% | 21 September and 21 March | NT2782 | AU3SG0002918 |

| 21 April 2037 | 5.75% | 21 April and 21 October | NTTC03 | AU3SG0003122 |

| 21 May 2038 | 5.25% | 21 May and 21 November | NT2783 | AU3SG0002967 |

| 21 March 2041 | 2.75% | 21 March and 21 September | NT2781 | AU3SG0002587 |

| 21 November 2042 | 4.10% | 21 May and 21 November | NT2773 | AU3SG0001746 |

| 21 March 2051 | 3.00% | 21 September and 21 March | NT2780 | AU3SG0002538 |

Other NTTC domestic bonds

NTTC has a number of smaller issues of domestic bonds outstanding that are not part of its domestic select lines of stock. NTTC cannot at this stage make any definitive statements regarding eligibility of these securities for the IWT exemption. Any domestic custodians holding such stock on behalf of offshore parties should contact NTTC on a case-by-case basis to clarify IWT status of these securities.

Give feedback about this page.

Share this page:

URL copied!