Client services

Loans to the Territory Government

NTTC lends funds to the Territory Government, government business divisions, government owned corporations, local authorities and other government organisations. Loans are issued in accordance with commercially based guidelines and practices.

All loans are approved by the Treasurer of the Northern Territory in accordance with section 13(2)(b) of the Northern Territory Treasury Corporation Act 1994 and section 31(1) of the Financial Management Act 1995.

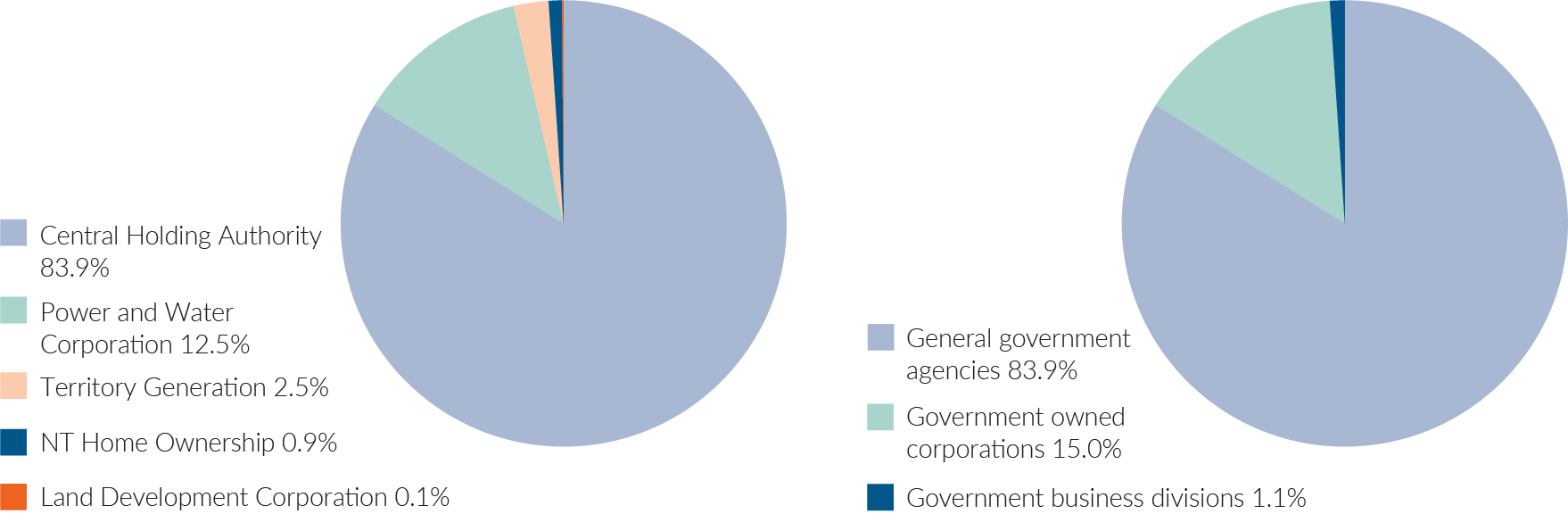

At 30 June 2024, NTTC had a total outstanding loan portfolio of $10.7 billion, about $1.3 billion higher than the balance reported at 30 June 2023. The figure below shows the breakdown of the total outstanding loans provided by NTTC at 30 June 2024. A full listing of NTTC’s loans is provided in the table below.

| 2024 $M | 2023 $M | |

|---|---|---|

| General government agencies | ||

| Central Holding Authority | 8 991 | 7 787 |

| Department of Territory Families, Housing and Communities | - | 55 |

| Total general government agencies | 8 991 | 7 842 |

| Government business divisions | ||

| Land Development Corporation | 15 | 15 |

| NT Home Ownership | 100 | 133 |

| Total government business divisions | 115 | 148 |

| Government owned corporations | ||

| Power and Water Corporation | 1 336 | 1 186 |

| Territory Generation | 272 | 250 |

| Total government owned corporations | 1 608 | 1 436 |

| TOTAL | 10 714 | 9 426 |

General government agencies

General government agencies are funded through Central Holding Authority (CHA) appropriations, some of which are funded by loans provided by NTTC. CHA is the 'parent body' that represents the Territory Government's ownership interest in government-controlled entities. The funds are used to finance general government activities and the Territory's major infrastructure projects.

Government business divisions

Loans to government business divisions represent borrowings by Territory Government-owned entities that operate on a commercial basis. The funds are used to finance capital and operating expenditure requirements.

Government owned corporations

Loans to government owned corporations represent borrowings by Territory Government-owned entities that operate on a commercial basis but their operations are not guaranteed by the Crown and do not make the Territory liable for their debts, liabilities or obligations. The funds are used to finance capital and operating expenditure requirements.

Investment portfolio

The Territory Government's investment portfolio is formed by pooling the surplus cash balances of government's bank accounts and investing in a variety of secure short, medium and long-term debt securities issued in the Australian financial markets.

The broad objectives of NTTC in managing the Territory's investment portfolio are:

- to ensure sufficient liquidity is maintained in the Government's cash balances to meet all financial obligations as they fall due

- to obtain a return on the Government's cash balances in line with the benchmark while adhering to the investment guidelines approved by the Treasurer.

The investment portfolio is composed of a range of secure investments of which a significant proportion are in short-term instruments including term deposits, bank accepted bills, promissory notes and negotiable certificates of deposit.

At 30 June 2024, the investment portfolio totalled about $1.4 billion, an increase of around $400 million from the previous financial year.

Conditions of Service Reserve

The Conditions of Service Reserve (COSR) is a segregated pool of investments held within CHA.

The funds are held at the discretion of the Treasurer and are intended for purposes such as meeting the Territory Government's unfunded superannuation liabilities. The funds are managed by three fund managers – AMP Capital Investors, Vanguard Australia and JANA Investment Advisors.

NTTC is responsible for monitoring and reporting on the performance of the fund and managing the relationship with the fund managers.

The investment performance of the fund is benchmarked against performance results for the 'growth' product category as published in the monthly Morningstar Market Index Performance. This is consistent with the asset allocation mix applied to COSR.

As at 30 June 2024, the market valuation of COSR totalled about $1.32 billion, an increase of around $130 million from the previous financial year.

Give feedback about this page.

Share this page:

URL copied!