Mineral Royalty

This page provides a high level overview of mineral royalties in the NT and how it compares with royalty schemes in other states.

The Mineral Royalty Overview DOCX (207.4 KB) further outlines the administrative arrangements relating to the establishment, calculation and collection of mining royalties under the Mineral Royalty Act.

Still looking for answers? Take a look at our frequently asked questions.

Who owns minerals in the Northern Territory?

Minerals in the Northern Territory are owned by the people of the Territory. Once a mineral is removed from the ground it cannot be replaced.

What are mineral royalties and what are they used for?

Companies mining minerals pay to remove non‑renewable resources. This payment is known as a royalty.

Mining royalties contributed more than 41% to the Territory’s total own‑source revenue in 2019‑20 and are the single largest own‑source revenue. Royalties are used to fund important public services such as schools, hospitals and community safety.

How are mineral royalties calculated?

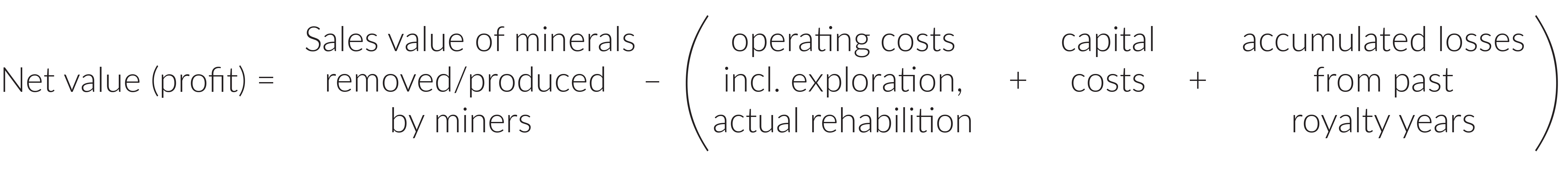

The Territory uses a net value system to calculate mineral royalties. Royalty for all minerals (except uranium) is calculated at a flat rate on the profit or net value from mineral production. The formula is:

The net value can be either negative (if a mine makes a loss) or positive (when a mine is returning a profit). Where the net value is positive and above the minimum royalty level (see What is the minimum royalty?), a royalty is payable at 20% of the net value.

Generally, with the net value system, less royalty is payable by marginal mines or on start‑up of a mining operation, when cash flow is often constrained. As a mine matures and makes more profit, more royalty is paid to the people of the Territory. Also, when mineral prices are high and profit goes up, more royalty is paid, and when prices drop, there is less profit so less royalty is paid.

The Territory’s royalty system is supportive of start-up mines, and recognises the high cost of remote deposits and low grade or hard-to-mine ore. Further, minerals are valued at the stage when they first become saleable, not on the subsequent processing or enhancement value. This means the system does not discourage downstream value‑adding or manufacturing activities.

What is the minimum royalty?

Under the Territory’s net value system, if a mine runs at a loss in a particular year or is generating a small profit, the miner only pays a minimum royalty of 1% to 2.5% depending on the age of the mine.

A mine will pay the higher of the minimum royalty or net value royalty calculation. It does not pay both in any given royalty year.

Typically, only mature and more profitable mines will eventually transition to the 20% net value royalty while the less mature, unprofitable or marginal mining ventures will only have to pay the minimum royalty.

How does the Territory compare with other states?

The 20% net value royalty rate often creates a perception of a relatively high royalty burden in the Territory. However, the 20% royalty rate is applied to the net value (after all eligible costs are deducted against revenue). Accordingly, the effective royalty rate (as a percentage of gross value) is much lower than 20%.

Due to the nature of the net value calculation, where royalty losses can be carried forward and capital expenditure is claimed (at inflated rates) over time, as well as a deduction for rehabilitation expenses, it is more accurate for the Territory’s royalty scheme to be compared with other Australian states’ royalty systems over the life of a mine, rather than at a single point in time.

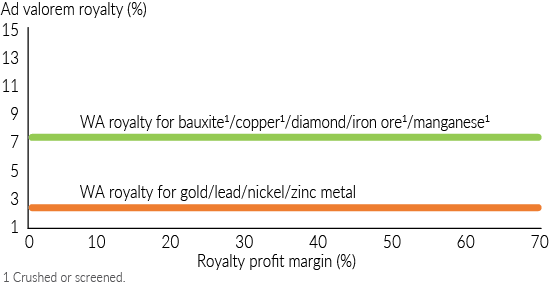

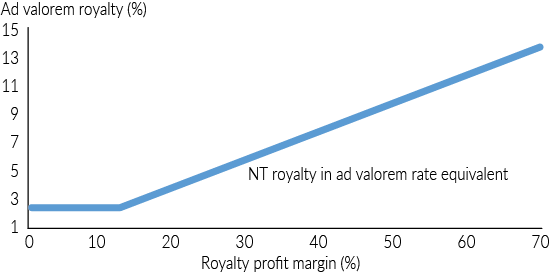

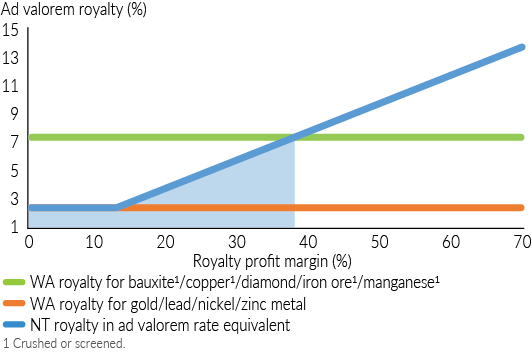

These charts illustrate how the royalty payable in the Territory compares generally with the royalty rates applicable in Western Australia for some mineral commodities.

| Chart 1 shows the royalty rate a mine must pay in Western Australia over the life of a mine for various minerals. The ad valorem rates of royalty are applied to the gross sales revenue regardless of the size, location or amount of profit a mine is generating. As profitability increases, the royalty remains fixed. |

| Chart 2 shows that as a Territory mine’s profit increases, so too does the royalty payment. When the mine experiences a loss or earns a minimal profit, the royalty is capped at the 2.5% minimum rate. In broad terms, the profit margin has to exceed about 12.5% before more than the minimum royalty is paid. |

| Chart 3 combines charts 1 and 2 to compare the royalty payable in Western Australia and the Territory based on the profitability of a mine. In general, about 80% of active Territory mines (the shaded section) are paying royalty at less than 7.5% ad valorem rate equivalent. |

Give feedback about this page.

Share this page:

URL copied!